Overestimated in the Short Run, Underestimated in the Long Run: A Blockchain & AI Introduction

Overestimated in the Short Run, Underestimated in the Long Run: A Blockchain & AI Introduction

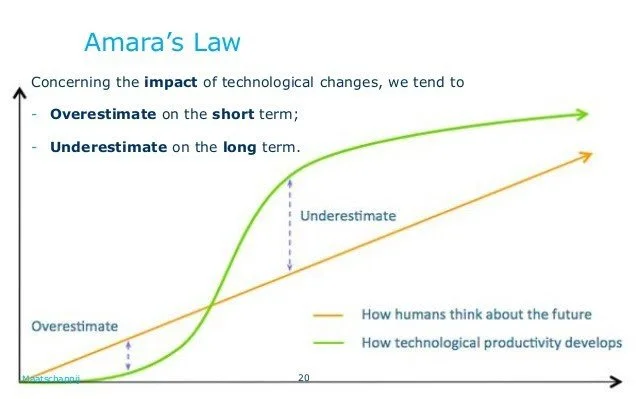

In the realm of technological innovation, a famous observation reminds us to keep our expectations in check. It comes from Roy Amara—a noted futurist and former president of the Institute for the Future—who noted that people often,

‘overestimate a technology’s short-term impact, but underestimate its long-term effects‘

This principle, known as Amara’s Law, has become widely referenced in discussions about technological innovation, forecasting, and disruptive change. It is frequently cited when examining emerging fields such as artificial intelligence (AI) and blockchain, and even in reflecting on the early growth of the Internet. Amara’s Law serves as a reminder that initial hype can overshoot reality, while a technology’s true transformative impact often unfolds gradually over time.

This principle is vividly on display in both the blockchain and cryptocurrency domain and the current wave of artificial intelligence. We saw crypto-assets skyrocket in 2021 only to crash in 2022, and many concluded blockchain was “all hype” – even as its real adoption quietly accelerated. Now, in 2024–2025, AI is riding a similar crest of inflated expectations, and a pullback is emerging. Yet if history is any guide, the long-term changes from these innovations are likely to be revolutionary, albeit realized on a timeline longer than the hype cycle.

Our investment strategy is grounded in this understanding: we invest in innovation cycles, not pricing cycles, positioning us to capitalize on true technological traction rather than short-lived market euphoria.

In this report, we examine how blockchain technology was overestimated in the short term (during the 2021 bubble) but is being underestimated now, and how AI is arguably overhyped today but its long-run impact is underappreciated. We draw parallels between crypto and AI to illustrate this dynamic.

Finally, we outline how our strategy – backing fundamental innovation through the troughs of disillusionment – paid off with blockchain and underpins our approach to the AI revolution (including our AI Access strategy focused on early-stage venture). This long-horizon perspective helps us cut through short-term noise and invest in the future beyond the hype.

Blockchain: From 2021 Bubble to 2025 Integral Financial Network

The crypto boom of 2021 ended in a familiar fashion—speculative excess followed by a sharp collapse. Valuations peaked near $3 trillion, with NFTs and meme coins dominating headlines. By late 2022, the bubble had burst, wiping out billions in value and leaving many to dismiss blockchain as a passing fad.

But beneath the price wreckage and news headlines, something more durable was taking shape.

Over the last three years, blockchain has quietly matured into critical infrastructure for modern finance. What was once an overhyped novelty is now embedded in payments, settlements, and asset issuance. This shift hasn’t captured headlines—but it has captured real adoption.

Stablecoins Have Become Systemically Important

Stablecoins exemplify this transformation. These digital dollars now move trillions annually and settle transactions instantly across borders. With over $300 billion in circulation and more than $1 trillion in monthly volumes, they have outpaced many legacy payment systems. Their integration into major platforms—like PayPal, Visa, and Mastercard—signals that blockchain-based money is no longer theoretical. It’s operational.

Dollar-pegged stablecoins are no longer niche instruments. Tether (USDT) and USDC now collectively hold more than $150 billion in U.S. Treasuries—placing stablecoin issuers among the top 20 holders of U.S. government debt when compared to nation states. That alone underscores how deeply these digital dollars have become embedded in the global financial architecture.

Stablecoins now move value faster, cheaper, and more flexibly than legacy payment systems. They operate 24/7 across borders, settling transactions in seconds. In 2025 alone, stablecoins are on track to surpass $9 trillion in total payment volume—facilitating not just crypto trading, but also remittances, FX settlements, and corporate treasury functions. In effect, they have become the Internet-native equivalent of cash and clearing infrastructure.

Tokenization Is Institutionalizing Blockchain

While stablecoins address payments, tokenization is transforming capital markets. By mid-2025, over $24 billion in real-world assets had been issued natively on blockchains—a nearly 5x increase from 2022. Tokenized U.S. Treasuries alone grew nearly eightfold in 2024, as institutions embraced the speed, transparency, and efficiency of on-chain issuance.

This is no longer just theory. JPMorgan, HSBC, and Franklin Templeton are now executing trades, swaps, and fund operations directly on blockchain rails. Standard Chartered projects tokenized assets could reach $30 trillion by 2030. BlackRock and Apollo have already moved parts of their portfolios on-chain—including via our portfolio company Securitize, which is now set to go public through a merger with Cantor Fitzgerald.

Tokenization improves not just settlement but access, liquidity, and operational resilience. For institutions, it offers infrastructure upgrades without replacing financial products—making it a pragmatic bridge between old and new.

The Upshot

While the 2021 bubble led many to dismiss crypto as a passing fad, blockchain never disappeared—it kept evolving. Innovation continued, adoption accelerated, and today the technology has quietly become part of the financial system’s core infrastructure.

Just a few years removed from the hype cycle, blockchain as a sector is potentially undervalued by markets and public perception relative to the utility being built. The headlines may have faded, but behind the scenes, leading financial institutions are scaling real-world deployments.

AI: Hype Peaks and the Long Game Ahead

If blockchain is in its “undervalued” phase after a hype cycle, artificial intelligence is, in many respects, in the opposite part of the cycle. The recent AI boom – driven by breakthroughs in generative AI and epitomized by products like OpenAI’s ChatGPT (launched late 2022) – has ignited tremendous excitement across industries. In 2023 and 2024, venture capital and corporate investments flooded into AI startups. Companies large and small began touting AI integration, and a few big winners (like NVIDIA in hardware and the tech giants in cloud AI) saw their stock prices soar. By 2025, AI-driven enthusiasm had powered a significant stock market rally, contributing to record highs in major indexes. In fact, since the debut of ChatGPT, the combined market capitalization of companies perceived as “AI players” has swelled by over $19 trillion, an astonishing figure that underscores the level of optimism priced into AI. We have witnessed what one might call an “AI bubble” in the making – or at least a period of inflated expectations.

This frantic pace of AI investment and sky-high valuation multiples has started to draw comparisons to the late-90s dot-com bubble. Are we overestimating AI’s near-term potential? There are legitimate signs of excess. Goldman Sachs analysts warned recently in 2025 that the market may have “already priced in” much of AI’s prospective gains, noting that investors often over-extrapolate during major innovation. When every company even tangentially related to AI is bid up, it implies expectations of industry-wide windfall profits that may not materialize immediately. JPMorgan’s strategists have voiced a similar caution, drawing parallels to 1999: large sums are being spent on AI without a clear sense of how usage and profits will ramp up, which “appears to be the issue with AI today”.

In short, AI in 2025 is likely overestimated in the short run. Early deployments of generative AI, while impressive, still struggle with limitations (accuracy, bias, high compute costs), and many AI startups are pre-revenue or have only pilot projects. A shakeout or correction in the AI space would not be surprising – indeed, we saw some tech stocks pull back in late 2025 as investor optimism moderated.

Despite these short-term risk signs, it would be a mistake to conclude that AI’s long-term value is hype. In fact, the long-run impact of AI is probably still being underestimated, just as the Internet’s impact was underestimated after the dot-com crash. Many experts see AI as a truly foundational technology – more like electricity or the Internet itself than a passing trend. The innovations happening now in machine learning, from natural language processing to autonomous systems, will gradually diffuse across every industry, transforming workflows and productivity. We’re already seeing glimpses of this transformative power, through gains in automation, efficiency, and innovation

The catch: these benefits will accrue over a decade or more, not overnight.

In other words, AI today is likely “overhyped in the short term but underestimated in the long term”. This dual reality is classic for general-purpose technologies.

Indicators of AI’s Long-Term Transformative Potential

Tangible Productivity Gains Already Visible: Even in this early stage, businesses adopting AI have seen substantial efficiency improvements. For example, generative AI tools (for coding, copywriting, data analysis, etc.) are cutting task times by 40–60% in some trials, allowing employees to focus on higher-level work. These measurable gains bolster the view that AI will significantly boost productivity across the economy – one of the key drivers of long-term GDP growth. Unlike some past tech fads that were confined to niches, AI is already delivering value in diverse contexts, hinting at much larger impact as the tech matures.

Ubiquitous Integration Across Industries: AI is not a single product; it’s a technology layer becoming embedded everywhere. We see AI’s spread in areas as diverse as finance (algorithmic trading, fraud detection), healthcare (AI diagnostics, drug discovery), manufacturing (predictive maintenance, robotics), and even creative fields (AI-assisted design and media). This breadth means AI’s effect is multiplicative – it will reinvent processes across the board. Over the long run, this pervasive integration suggests AI will be as commonplace and indispensable as electricity or the Internet, forming a new invisible infrastructure behind the global economy.

Continual Technological Advancements: The trajectory of AI capability is still steeply upward. Ongoing advances in semiconductors (GPUs, TPUs) and software architectures are rapidly improving what AI can do and at what cost. Each year brings larger and more efficient models, new algorithms, and better data. This has a compounding effect: for instance, what was barely achievable at great expense a few years ago (like real-time speech translation, or human-level image generation) is now feasible and will be ubiquitous in another few years. The long-term view takes into account that AI will keep getting better and more reliable, which in turn will unlock new applications. We likely haven’t even conceived of some of the major uses AI will have in 10+ years – just as someone in 2000 couldn’t fully envision Uber or Instagram enabled by mobile Internet. This continual improvement means the ceiling for AI’s impact is moving higher, even if today’s valuations momentarily overshoot reality.

In summary, the current AI frenzy will likely settle down (with some investors getting burned in the correction), but the true revolution AI brings about in the next decade will far exceed what most skeptics today anticipate.

For investors, the challenge is navigating this cycle wisely – to avoid overpaying at the peak, but also to avoid losing faith in the technology’s long-term promise when the hype fades. This is exactly where our strategy comes in.

Letter from London: Investing in Innovation Cycles, Not Pricing Cycles

Faced with volatile hype cycles, our firm’s philosophy remains clear: focus on innovation fundamentals—not speculative price waves. We believe in investing in innovation cycles, not pricing cycles.

That means entering early in a technology’s lifecycle—when it’s still underappreciated—and staying patient through hype-driven peaks and sentiment-driven troughs.

We invest at the earliest stage through a diversified fund-of-funds model, backing up to 15 specialist early-stage venture firms. As standout companies emerge, we selectively follow on at the later stages with concentrated direct investments in portfolio leaders.

This disciplined, long-term approach has consistently positioned us to capture gains as innovation matures into infrastructure.

Blockchain illustrates this clearly. After the crypto bubble burst in 2021, many fled the space. We did not. Despite price declines, we saw continued growth in developer activity, stablecoins, and enterprise blockchain adoption.

We doubled down—investing in the teams and infrastructure enabling blockchain-based payments, security, and asset tokenization. Those investments, made when sentiment hit bottom, are now bearing fruit. As blockchain becomes essential financial infrastructure in 2024–2025, the companies we backed early are gaining traction.

We’re taking the same approach to AI. There’s no doubt AI is in a hype phase, so we’re not chasing today’s market darlings.

Instead, we’ve launched our AI Access Fund of Funds, backing early-stage venture firms focused on AI at the seed and Series A levels. This gives us exposure to the next generation of AI companies—before the bidding wars and while valuations still reflect underlying risk. By partnering with specialist VCs, we access deep technical insight and high-potential teams far ahead of the crowd.

This is how we build meaningful positions in the foundational ecosystem that will shape AI’s next decade—not the headlines of this quarter.

There are positive structural features to this model:

Lower Entry Valuations: Early-stage investments let us get in before the price runs up.

Broad Innovation Exposure: Select AI funds that give us diversification across use cases—from infrastructure to healthcare to enterprise software.

Insulation from Public Market Noise: These long-horizon, illiquid investments aren’t subject to daily volatility.

Deeper Insight: At the ground level, we can distinguish real breakthroughs from buzz—and support the teams building lasting value.

Amara’s Law captures our philosophy well: “We tend to overestimate the effect of a technology in the short run and underestimate it in the long run.”

Blockchain taught that lesson as it went from mania to dismissal—and is now emerging as critical financial infrastructure. AI may be in the opposite phase now—peaking in attention—but in the long run, its impact will likely be even greater than expected.

Ultimately, our North Star is simple: focus on the real, long-term innovation cycle, and the returns will follow. We’re not chasing hype—we’re investing early, with conviction, and staying through the buildout. That’s where the compounding happens. That’s where the future gets built. And that’s where we want to be.

Thanks for reading,

Mitchell Mechigian

Partner, London

About Fifth Era

We are entering a period of unprecedented innovation we call the Fifth Era, and every industry and business will be dramatically impacted. We focus on investing into these new innovations. Fifth Era specializes in investment strategies which construct portfolios of hard-to-access funds and direct investments through our investment strategies - AI Access and Blockchain Coinvestors. Fifth Era's investment strategies are now in their 12th year and to date we have invested in a combined portfolio of 1,500+ companies and projects including 80+ unicorns. In the US we are a SEC registered investment advisor, in the UK a FCA appointed representative and our funds are registered in Switzerland. Visit us at www.FifthEra.com to learn more.

SEC Registration does not imply a certain level of skill or training.

“Focused on Innovation”