Expanding our Investment Focus From Blockchain to AI too

Expanding our Investment Focus From Blockchain to AI too

We have been busy over the summer, and in this week's newsletter we cover off several pieces of news that we hope you will find exciting:

New regulatory status

New name and branding

Expansion of our investment strategies from Blockchain and Crypto to include Artificial Intelligence (AI) too.

Each of these is discussed in turn, and the focus of today's newsletter will be on our new AI Access strategy.

New Regulatory Status and A New Brand

As a result of your support, we are now larger and more international than ever, and this has required us to upgrade our regulatory footprint:

In the US we are now a SEC registered investment advisor*,

In the UK a FCA appointed representative, and

Our funds are registered in Switzerland.

* Legal notice - SEC Registration does not imply a certain level of skill or training.

As part of this process, we took the opportunity to reflect on how we see the world evolving, what investment opportunities we expect to surface, and what our investors are asking us for. This led us to conclude that the RIA upgrade process was an appropriate time to 'rebrand'. In summary:

We are rebranding our firm,

Returning to our heritage as Fifth Era Partners,

With Blockchain Coinvestors as the name of our investment strategy focused on Blockchain and Crypto,

With a new investment strategy, AI Access, complementing it and expanding our investment opportunities and focus.

Please see Exhibit 1 below for our new brand architecture.

Exhibit 1: Fifth Era Partners Now Launched

Revised Vision and Mission

We have also adjusted our vision and mission, returning it to the broader scope that we defined and wrote down back some 15 years ago.

Who We Are: We are a specialized asset manager providing access to exponential technologies that are transforming our world.

Our Vision: We are entering a period of unprecedented innovation we call the Fifth Era, and every industry and business will be dramatically impacted.

Our Mission: We focus on investing into these new innovations.

How We Invest: Fifth Era Partners LP (“Fifth Era”) specializes in investment strategies which construct portfolios of hard-to-access funds and direct investments: AI Access and Blockchain Coinvestors.

For the rest of today's newsletter, we are going to focus on Artificial Intelligence and our new investment strategy AI Access, and going forward one newsletter a month will exclusively focus on this topic, while the other two monthly newsletters continue to focus more on Digital Finance and Blockchain and Crypto.

Evolving Our Strategy: A Focus on AI

For years, we’ve helped investors access innovation at its source. Building on our proven fund-of-funds model, along with deep relationships across Blockchain, Crypto, and Silicon Valley’s ecosystem, we are now expanding into Artificial Intelligence (AI).

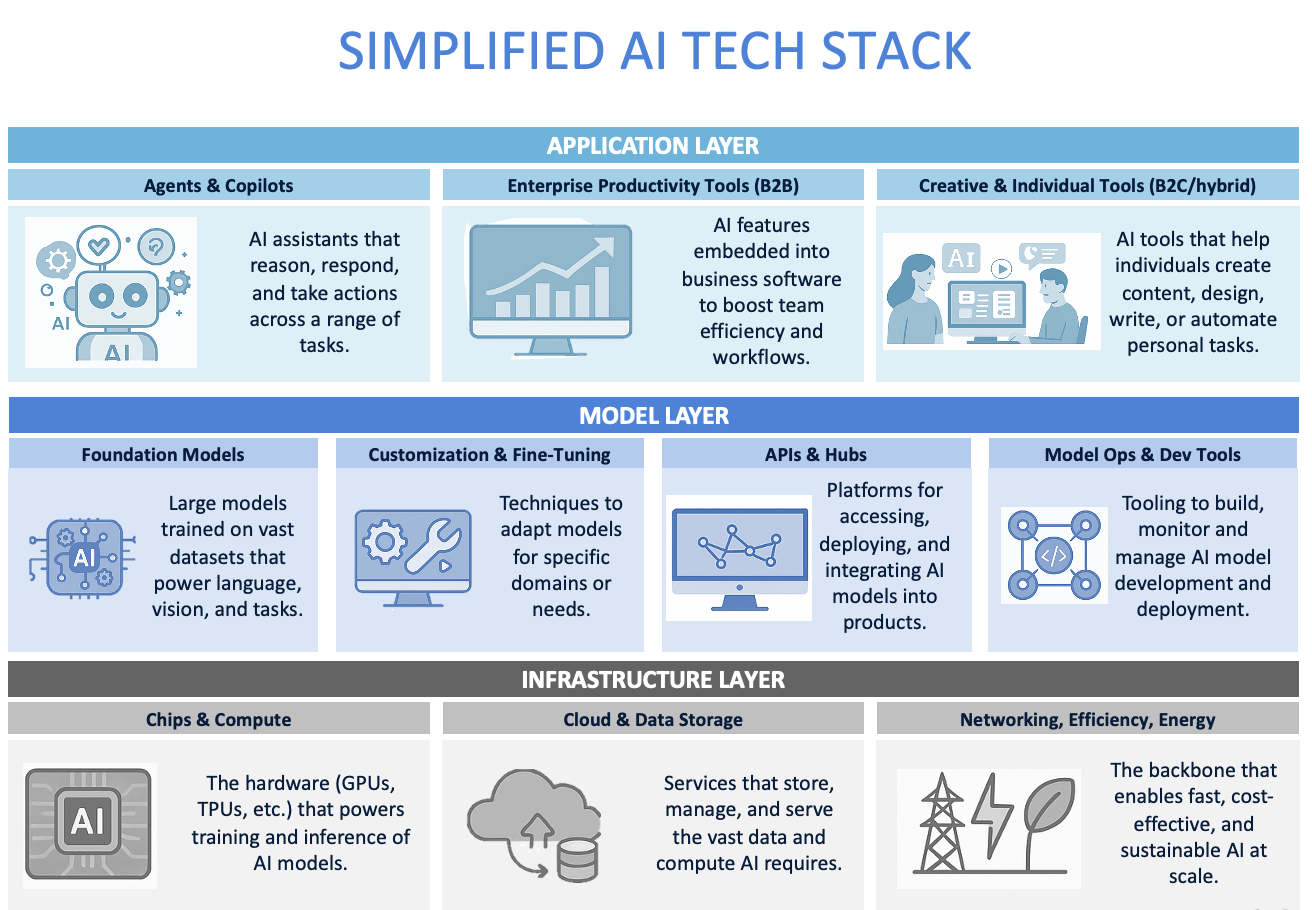

We’re excited to introduce our AI Access Strategy, designed to provide qualified investors with diversified exposure to the early-stage AI stack covering applications, models, and infrastructure. In addition to our core fund-of-funds portfolio, we plan to participate in highly selective direct and co-investment opportunities sourced through our extensive network of top-tier managers.

For those of you who know us well, this is simply the replication of our existing Blockchain investment strategy, now applied to AI too.

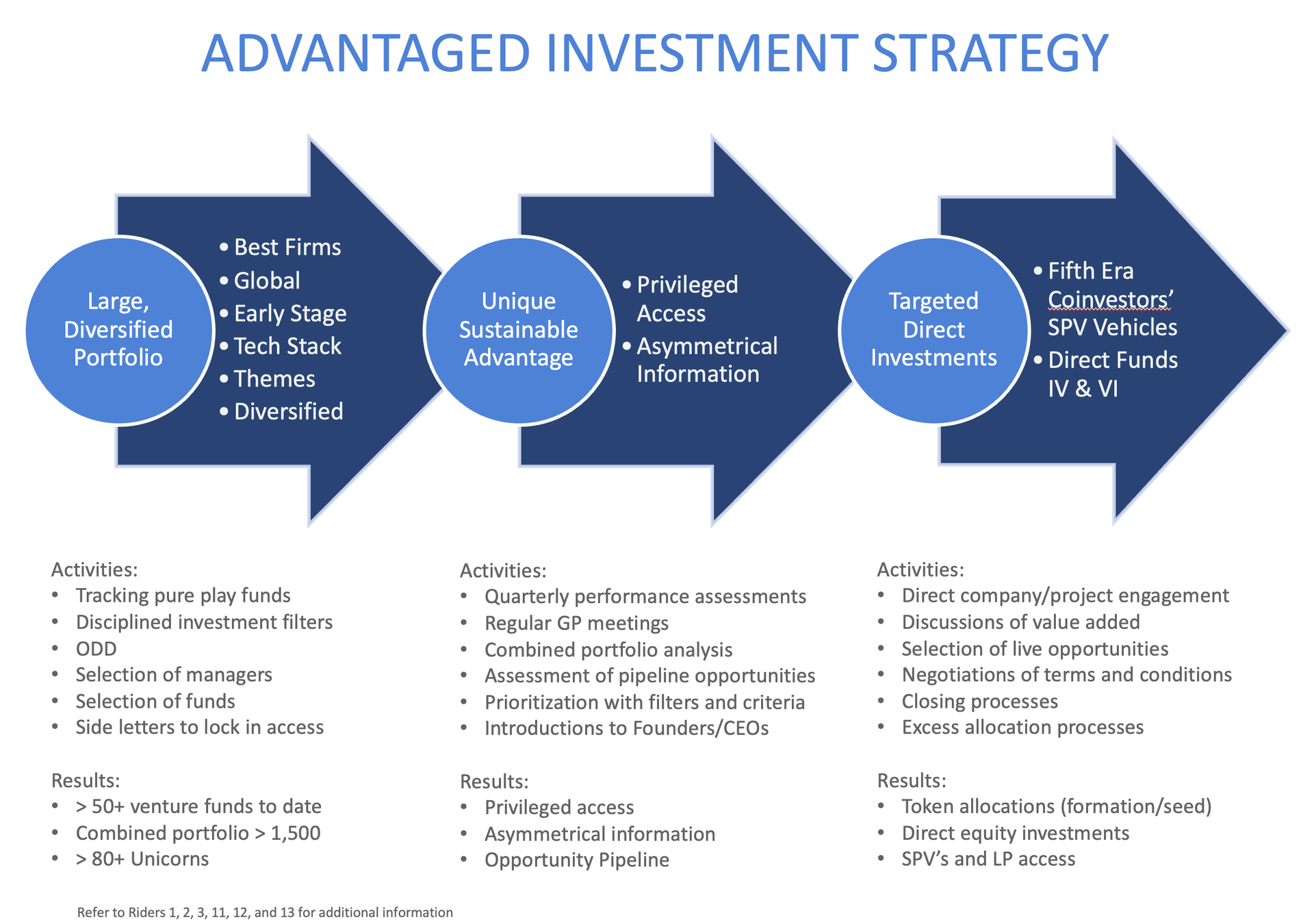

A Simple, Disciplined Approach

Our approach is straightforward and disciplined:

Allocate to a concentrated set of leading AI-focused venture funds.

Amplify access to privileged deal flow and pattern recognition.

Selectively co-invest where appropriate, balancing risk and reward.

The goal? Capture value creation while minimizing single-manager and single-theme risk.

Exhibit 2 below is one we have shared for years. Now adjusted to our new world.

Exhibit 2: Advantaged Investment Strategy

Why AI? The Next Frontier of Innovation

AI is ubiquitous… Just as the Internet transformed industries, geographies, and human interaction over the last three decades, AI will underpin everything we do. It will rewrite not only how companies operate, but also how we live, learn, and connect. We're still at the very beginning—much like the early Internet era when social media, e-commerce, and real-time communication were unimaginable.

Over the coming months, we will share more insights and perspectives to help you come up the curve on AI and the opportunities it may present. However to get you started, take a look at Exhibit 3 which is the simplified AI stack. In future newsletters we will talk more about this - but ask today for a briefing if you want to consider our AI Access strategy.

Exhibit 3: Simplified AI Tech Stack

AI has been researched since the 1950s; however, it has now reached an inflection point—a J-curve of growth that will likely reshape the global economy.

Expect more education and insights from us in the coming months.

Cutting Through the Noise

The current enthusiasm has spawned many superficial “wrappers” on large language models and AI tools unlikely to endure. Early enterprise experiments often show uneven returns due to scattershot approaches.

Our focus remains on where lasting companies are often built—the early stage, where valuations appear more reasonable and upside potential may be higher.

We partner with discerning venture managers—technical builders and experienced investors who have backed AI for years, not just chasing hype.

Their expertise helps differentiate enduring solutions from fleeting experiments, and their judgment compounds over time.

Again you have heard us talk about these best practices with regard to Blockchain and Crypto early stage investing. They are true for AI too.

AI Access Investment Strategy

We’re thrilled to offer our investors exclusive access to this evolving landscape through our AI Access investment strategy.

Gaining entry to venture capital is challenging—these networks are built on decades of trust and shared experience.

Our team has cultivated venture relationships through multiple innovation cycles, and now we are accessing those relationships for our AI investing strategy.

In addition, we expect to provide direct and co-investment deals sourced via our venture capital partners—similar to our blockchain playbook

If you’re interested in learning more or expressing your interest in the AI Access Strategy, please reach out to IR@FifthEra.com.

We look forward to welcoming you on this exciting journey.

The Fifth Era Partner Team

About Fifth Era

We are entering a period of unprecedented innovation we call the Fifth Era, and every industry and business will be dramatically impacted. We focus on investing into these new innovations. Fifth Era specializes in investment strategies which construct portfolios of hard-to-access funds and direct investments through our investment strategies - AI Access and Blockchain Coinvestors. Fifth Era's investment strategies are now in their 12th year and to date we have invested in a combined portfolio of 1,500+ companies and projects including 80+ unicorns. In the US we are a SEC registered investment advisor, in the UK a FCA appointed representative and our funds are registered in Switzerland. Visit us at www.FifthEra.com to learn more.

SEC Registration does not imply a certain level of skill or training.

“Focused on Innovation”