Behind Gold’s Rise: Bitcoin and the Future of Blockchains

Behind Gold’s Rise: Bitcoin and the Future of Blockchains

As I write from London, unicorns continue to be minted across the blockchain ecosystem, and several of our portfolio companies are advancing through the public markets pipeline—including BitGo, Kraken, and Securitize. Against this backdrop, the recent World Economic Forum in Davos underscored a striking tale of two worlds, with blockchain technology sitting squarely at the center.

On one side, we are seeing a global realignment that is forcing countries to rethink their relationship with the United States. One of the clearest early symptoms of this shift has been the rapid rise in gold prices. On the other side, adoption of stablecoins and tokenization within the U.S. financial system is accelerating, potentially reinforcing dollar dominance for another generation.

These developments may appear contradictory. In reality, they are deeply related.

A Shifting Global Order

We may be in the midst of a geopolitical realignment unlike anything seen since at least 1989, following the collapse of the Soviet Union — if not since the post-World War II Bretton Woods era. Relationships between the U.S., Europe, China, and Russia continue to evolve, often unpredictably.

Amid this uncertainty, the U.S. dollar has weakened, while gold and silver have seen notable appreciation over the past year. These moves came into sharp focus during the Davos conference, where over on this side of the pond, much of Europe was glued to screens watching President Trump’s remarks — including speculation around Greenland — as a proxy for broader geopolitical direction.

Gold’s rise, however, is better understood as a symptom, not a cause. It reflects a consistent and growing trend around the global financial system and an increasing desire among some countries to reduce reliance on U.S.-controlled financial infrastructure.

Gold, Bitcoin, and Financial Censorship

This shift toward perceived “safe” assets — and away from the dollar— is precisely the environment Bitcoin and cryptocurrencies were designed for. You can see in the chart below, Gold has risen considerably this year, outpacing Bitcoin.

Chart 1: Bitcoin vs Gold Last 12 Months

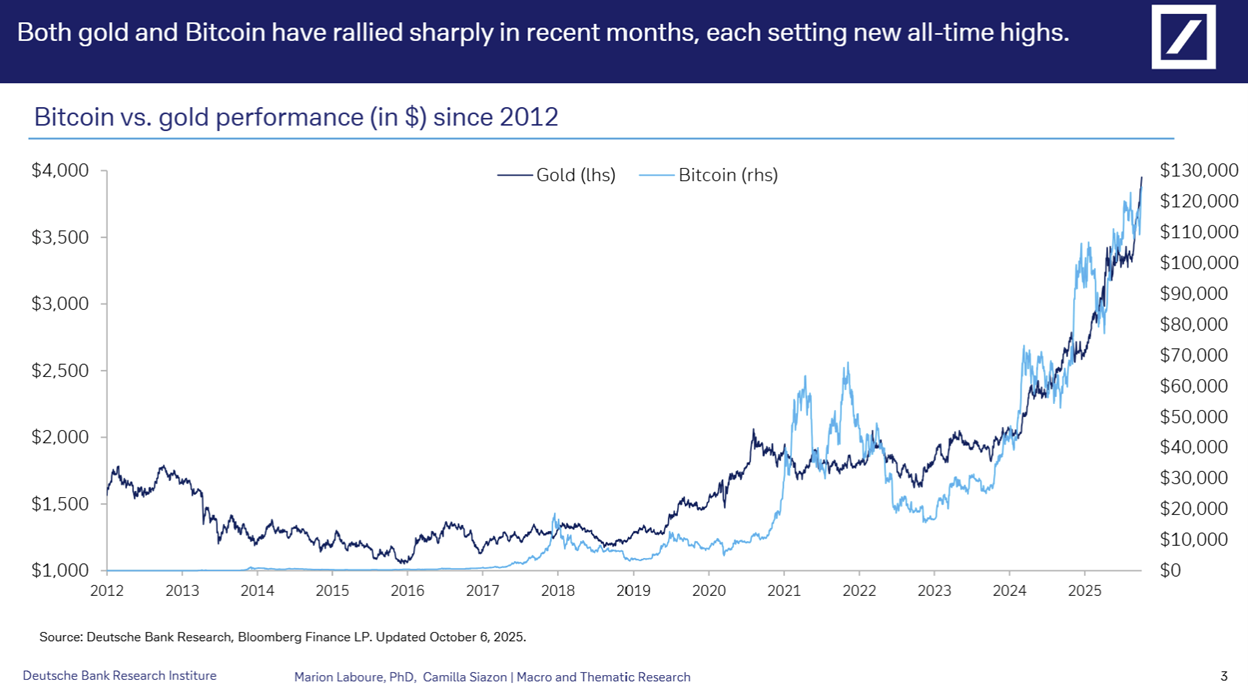

While at first glance, this may cause some to believe that Gold is the only beneficiary of this shifting global order, zooming out paints a different story.

Chart 2: Bitcoin vs. Gold Last 5 Years

Over the past five years, Bitcoin and gold have broadly moved in tandem. In many ways, gold today appears to be catching up to a trade that Bitcoin has been signaling for over a decade.

What is causing this trend?

A key driver may have been the realization that U.S. control over the global financial system introduces non-trivial political risk for countries around the world.

Following Russia’s invasion of Ukraine in 2022, the U.S. and its allies responded with severe financial sanctions. Russian banks were removed from the SWIFT messaging system, cut off from dollar-based correspondent banking, and isolated from global capital markets. Major payment networks such as Visa, Mastercard, and American Express suspended operations in Russia, rendering many familiar payment methods unusable.

Regardless of one’s view on the sanctions themselves, the broader takeaway was unmistakable: access to the global financial system can be revoked for political reasons. Other countries — including China, Saudi Arabia, and others — took note.

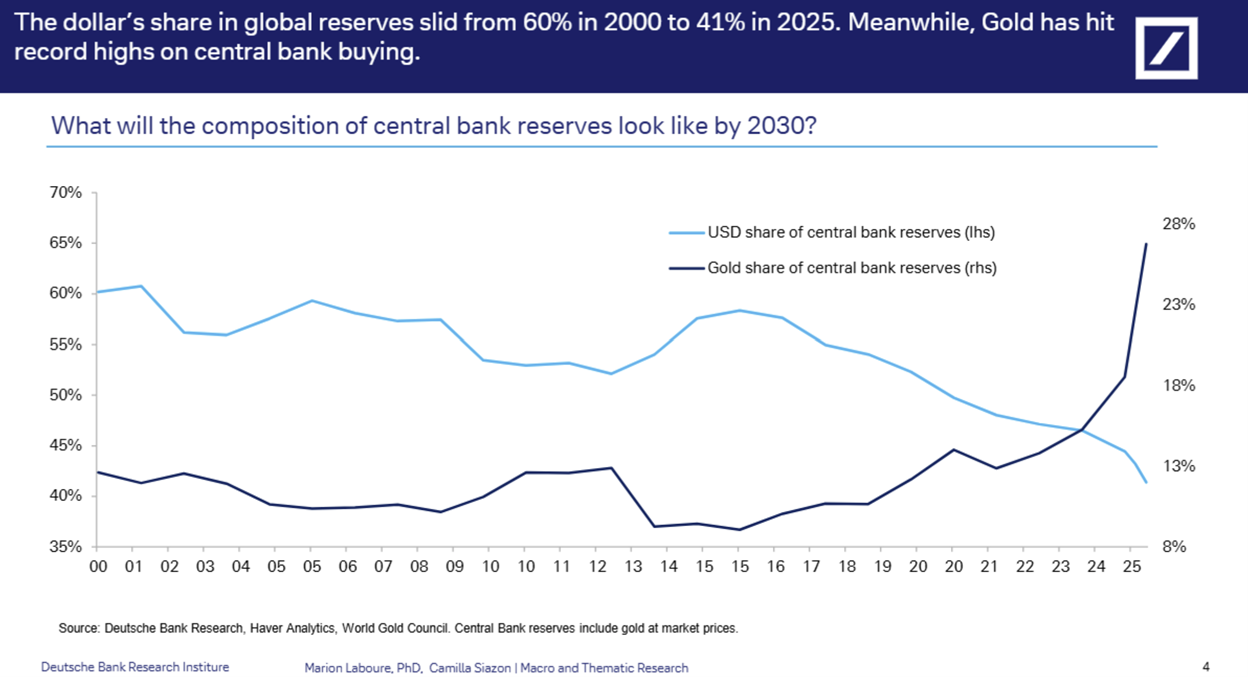

Central banks have been steadily increasing gold reserves while, in some cases, reducing dollar exposure.

Chart 3: Dollar and Gold % of Central Bank Reserves Since 2000

What these countries increasingly seek is censorship resistance: payment, reserve, and settlement systems that cannot be unilaterally switched off. Two assets that clearly exhibit this property are gold and Bitcoin — neither can be disabled by a decision made in New York or Washington.

Public blockchains are inherently permissionless: anyone can use them, and they are built on open-source infrastructure rather than centralized control. As this dynamic continues to play out, we expect public blockchains that are increasingly embedded in the financial system — such as Ethereum and Solana — to accrue similar benefits over time.

Chart 4: Bitcoin vs. Gold 2012 to 2025

Stablecoins and the Tokenization of Finance

At the same Davos conference — though drawing less attention than geopolitics — many of the world’s leading financial figures were focused on the future of markets. Crypto, particularly stablecoins and tokenization, was central to the discussion.

BlackRock CEO Larry Fink described tokenization as the next major evolution in global financial markets, noting that tokenized assets could move seamlessly between money market funds, equities, and bonds. BlackRock has referred to stablecoins as “tokenization in action,” emphasizing their role well beyond speculative crypto trading.

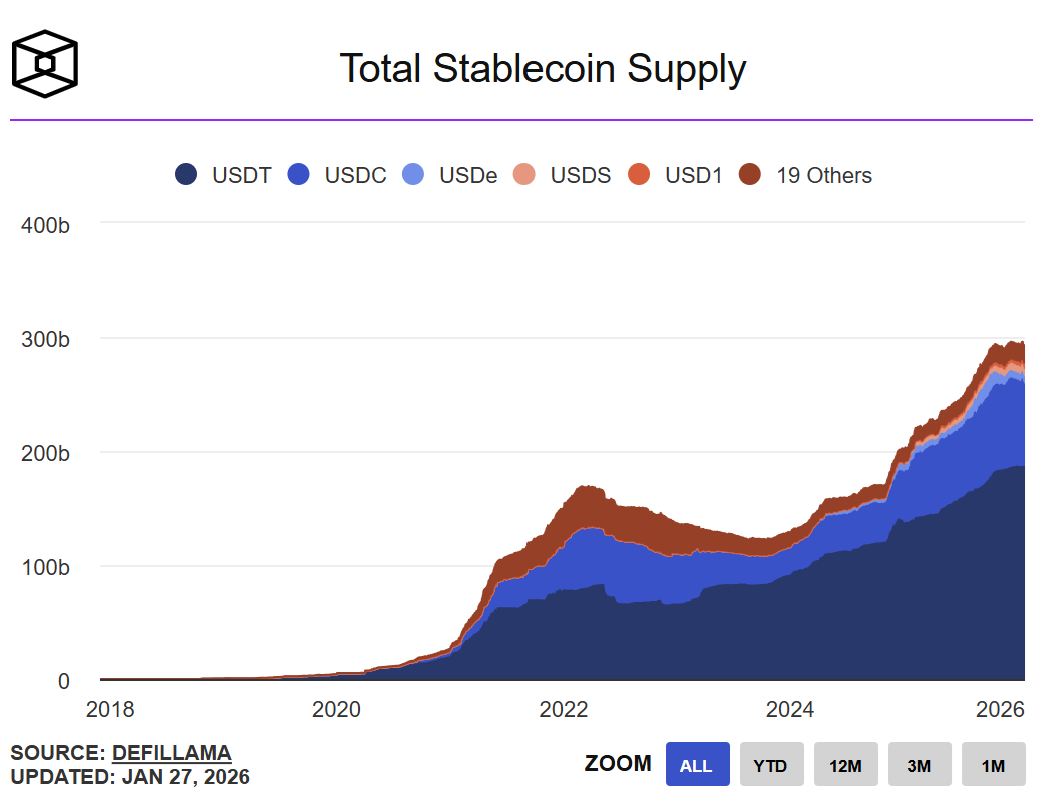

Chart 5: Total USD Stablecoin Supply

Stablecoins have quietly become a critical component of the U.S. financial system. Tether, the largest stablecoin issuer, is now among the top purchasers of U.S. Treasuries, which it holds as reserve collateral. At the same time, stablecoin networks are settling payment volumes that rival those of Visa and Mastercard.

Globally, stablecoin adoption is overwhelmingly concentrated in dollar-denominated instruments. This underscores the continued strength of global demand for dollars and suggests that stablecoins may help extend dollar dominance into the next generation of financial infrastructure.

If you’ve been following this letter, this development aligns closely with our core thesis: blockchains enable a fundamental rebuilding of financial infrastructure through tokenization. We have invested in companies such as Securitize — backed by BlackRock and preparing to go public — because we believe this shift is structural, not cyclical.

The direction of travel is increasingly clear, and global financial leaders see it as well.

The View from London

As long-term, private-market investors, we do not trade headlines. But we do pay close attention to political and macro signals to understand where long-term capital flows are headed.

From our vantage point, two durable trends are becoming clearer:

Growing demand for censorship-resistant financial systems outside the U.S.

This includes payments, reserves, and currency settlement. Over the long term, this is highly constructive for Bitcoin and permissionless blockchains — systems that cannot be switched on or off by any single authority.

Deepening adoption of crypto within the U.S. financial system.

Stablecoins are already systemically important and are likely to help the dollar maintain dominance in the near to medium term. At the same time, tokenization appears poised to reshape capital markets, with the U.S. leading that transition.

While these forces may seem to pull in opposite directions, they are both fundamentally bullish for blockchain adoption. We continue to invest accordingly, with a long-term view toward the technological transformation of global finance. For our investors already exposed to this asset class, the tailwinds certainly look promising. Please reach out to ir@fifthera.com if you'd like to discuss further.

Thank you for reading,

Mitchell Mechigian

Partner, London

About Fifth Era

We are entering a period of unprecedented innovation we call the Fifth Era, and every industry and business will be dramatically impacted. We focus on investing into these new innovations. Fifth Era specializes in investment strategies which construct portfolios of hard-to-access funds and direct investments through our investment strategies - AI Access and Blockchain Coinvestors. Fifth Era's investment strategies are now in their 12th year and to date we have invested in a combined portfolio of 1,500+ companies and projects including 80+ unicorns. In the US we are a SEC registered investment advisor, in the UK a FCA appointed representative and our funds are registered in Switzerland. Visit us at www.FifthEra.com to learn more.

SEC Registration does not imply a certain level of skill or training.

“Focused on Innovation”